cardinal health enterprise value

All numbers are indicated by the unit behind each term and all currency related amount. Cardinal Healths latest twelve months enterprise value ev is 17085 billion.

Historical Enterprise Value Data.

. The Director Enterprise Architecture drives value to Cardinal Health through their leadership experience broad data knowledge thought leadership and ability to establish and execute a strategy. 2022 adds up the quarterly data reported by the company within the most recent 12 months which was 176847 Mil. Cardinal Health Enterprise Value is increasing over the last several years with stable swings.

AmerisourceBergen Enterprise Value. Cardinal Healths Revenue for the trailing twelve months TTM ended in Mar. Earnings Estimates Cardinal Health Inc.

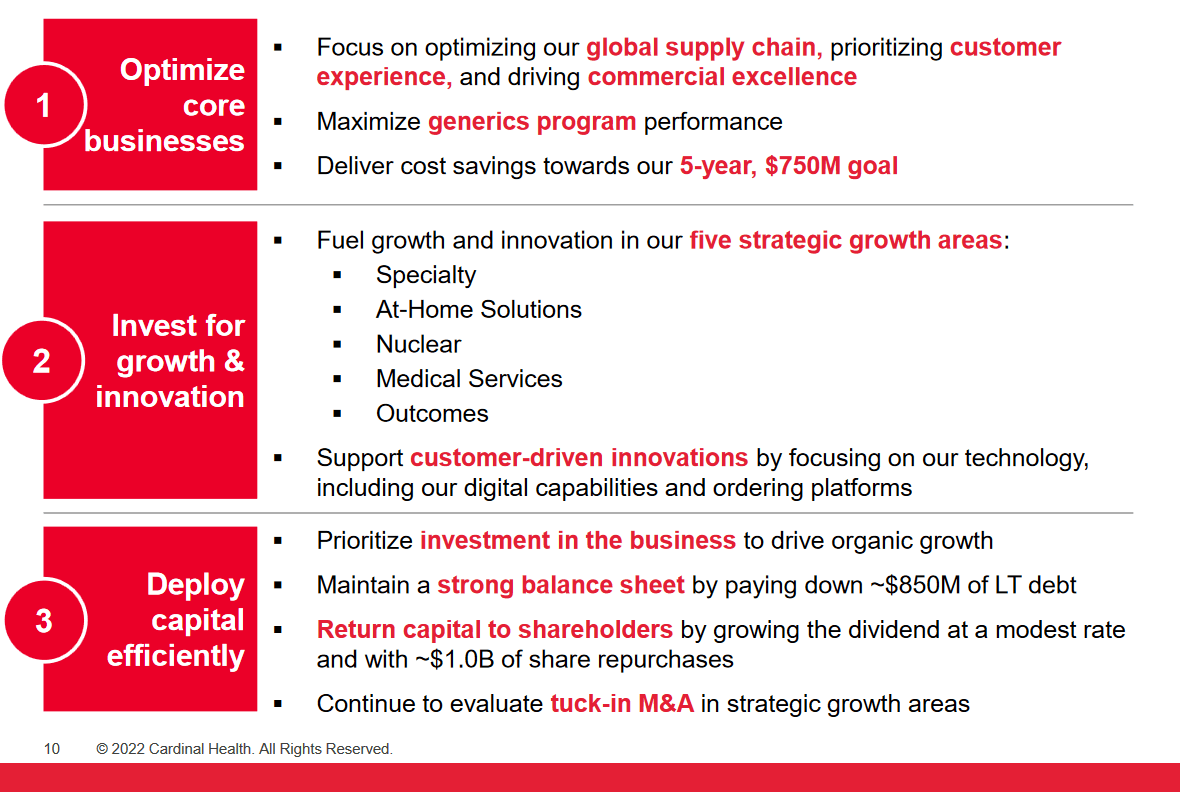

Global procurement is responsible for creating and managing diverse strategic supplier partnerships. 3531B for May 20 2022. Our model approximates the value of Cardinal Health.

Enterprise Value Range Past 5 Years. View and export this data back to 1985. To be assigned a value score stocks must have a valid non-null ratio and corresponding ranking for at least two of the six valuation ratios.

2022 adds up the quarterly data reported by the company within the most recent 12 months which was 176847 Mil. Accountable for 350m of global spend across raw material finished goods components for kitting and distributed products for cardinal health medical segment. Stocks with a value score from 0 to 20 are considered deep value those with a score between 21 and 40 are a good value and so on.

All numbers are indicated by the unit behind each term and all currency related amount. The current price of the firm is 5346. Cardinal Healths current Enterprise Value is 18103 Mil.

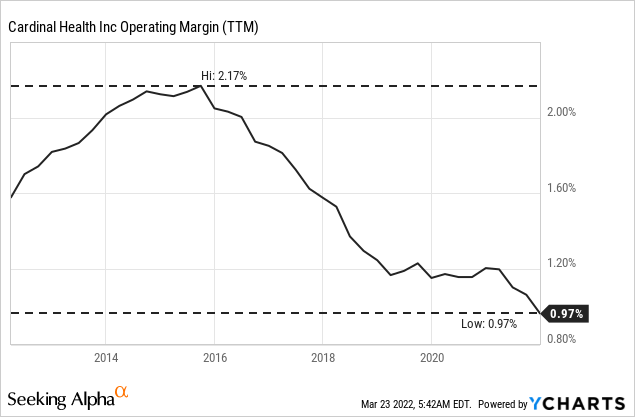

View and export this data back to 1995. Cardinal Health Enterprise Value over EBITDA vs Operating Margin relationship and correlation analysis over time. Specialty and global logistics businesses and continue to expand it across the enterprise.

View Cardinal Health Incs Enterprise Value EV trends charts and more. Enterprise Value is estimated to finish at about 247 B this year. Historical Enterprise Value Data.

26 rows Cardinal Health Enterprise Value. Cardinal Health shows a prevailing Real Value of 5692 per share. Stock CAH US14149Y1082.

Cardinal Health CAH - Enterprise Value - actual data and historical chart - was last updated on September of 2021 according to the latest Annual and Quarterly Financial Statements. Cardinal Healths current Enterprise Value is 18975 Mil. Cardinal Health Enterprise Value is most likely to increase significantly in the upcoming years.

What we value We aspire to be healthcares most trusted partner by building upon our scale and heritage in distribution products. 1612B Minimum Dec 01 2021. 4 5 Cardinal Health FY21 Corporate Citizenship Report Diversity equity and inclusion Our customers and partners.

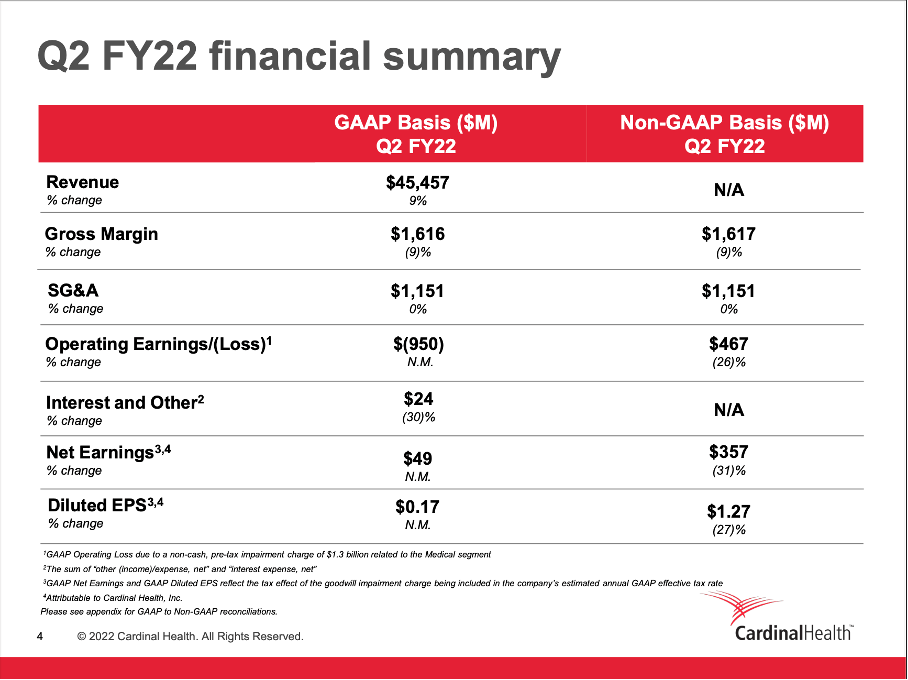

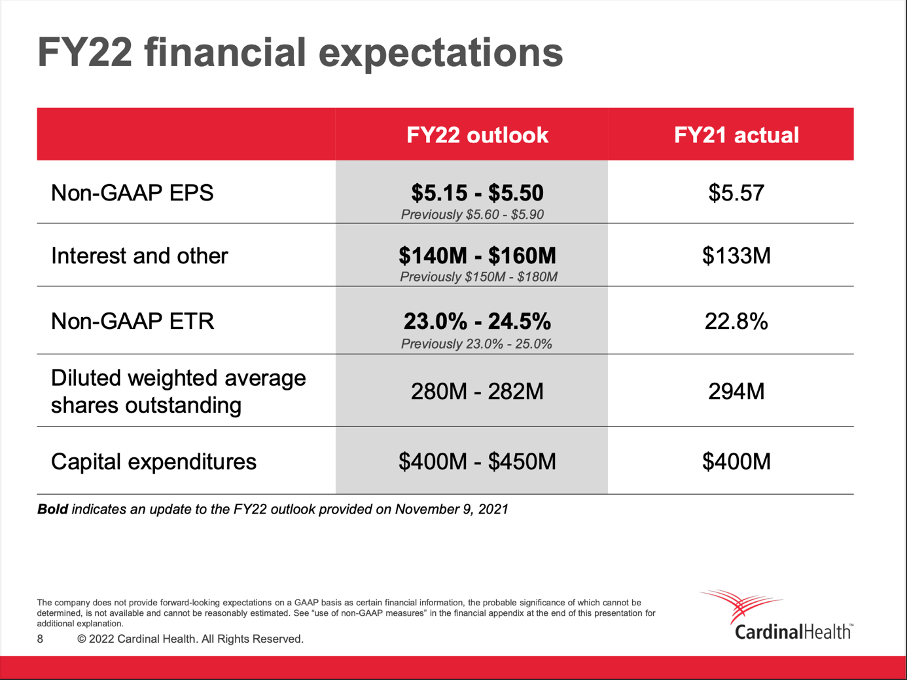

- Revenue increased 16 to 426 billion in the fourth quarter - GAAP1 operating earnings decreased 40 to 162 million and non-GAAP operating earnings decreased 28 to 320 million in the fourth quarter due to a COVID-19-related inventory reserve related to certain PPE in the Medical segment - GAAP diluted EPS were 040 and non-GAAP diluted EPS were. For Operating Data section. Cardinal Healths Revenue for the trailing twelve months TTM ended in Mar.

Cardinal health enterprise value. Forcasts revenue earnings analysts expectations ratios for CARDINAL HEALTH INC. At this time the firm appears to be undervalued.

1839B for April 6 2022. Year Ago 077 Q4 2021. Compare the enterprise value compound annual growth rate cagr 10y trend of Cardinal Health CAH and Universal Health Services UHS.

2022 Cardinal Health Inc. Analyze Cardinal Health Enterprise Value. Change value during other periods is calculated as.

Is a healthcare services and products company which engages in the provision of customized solutions for hospitals healthcare. During the period from 2010 to 20222010 to 2022. 4976B Henry Schein Inc.

We aspire to be healthcares most trusted partner by building upon our scale and heritage in distribution products and solutions while driving growth in evolving areas of healthcare through customer insights data and analytics and focusing our resources on what matters most. This role covers both the information and integration domains and will face off to a variety of stakeholders including the chief architects for the. CAH 5487 -096-172 Will CAH be a Portfolio Killer in May.

The Enterprise value factors in Market capitalization cash debt and other assets and liabilities. We would like to show you a description here but the site wont allow us. Get comparison charts for tons of financial metrics.

All rights reserved Legal Terms of Use. For Operating Data section. At this time the firm appears to be undervalued.

The preceding years Enterprise Value was reported at 2277 Billion. Cardinal Health Inc has a Value Score of 2 which is Deep Value. CARDINAL HEALTH INC.

CAH including valuation measures fiscal year financial statistics trading record share statistics and more. Find out all the key statistics for Cardinal Health Inc. The current Enterprise Value is estimated to increase to about 247 B while Free Cash Flow is projected to decrease to roughly 23 B.

Cardinal Health Siaraa Technologies

Cardinal Health Branded Environment Exhibitpro Case Study

Cardinal Health Login App Www Cardinalhealth Net Hr Employee Login

Cardinal Health Stock Remains A Bargain Nyse Cah Seeking Alpha

Splunk At Cardinal Health Business Innovation Behind The Healthcare Supply Chain Splunk

Cardinal Health Disposable Plastic Cover 4 X 4 Instant Infant Heel Warmer 11460 010t 1 Each Walmart Com

Cardinal Health Stock Remains A Bargain Nyse Cah Seeking Alpha

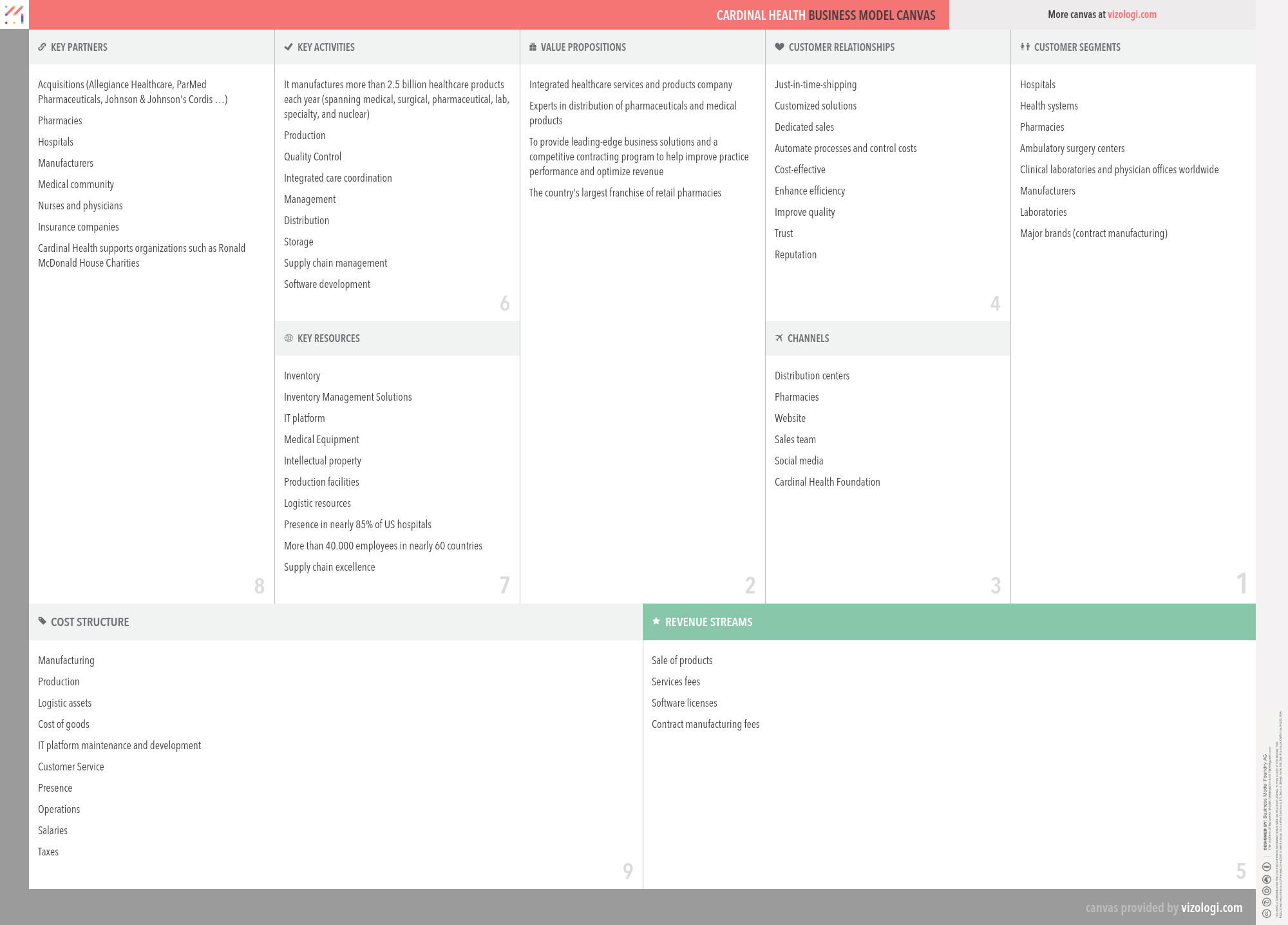

What Is Cardinal Health S Business Model Cardinal Health Business Model Canvas Explained Vizologi

Cardinal Health Stock Remains A Bargain Nyse Cah Seeking Alpha

Cardinal Health Stable And On The Road To Recovery Nyse Cah Seeking Alpha

Cardinal Health Branded Environment Exhibitpro Case Study

Cah Stock Price And Chart Nyse Cah Tradingview